The U.S. Department of Labor (DOL) published monumental changes to the overtime rule that will make approximately 4.2 million currently exempt employees eligible for overtime pay later this year.

The DOL has issued its long-awaited Final Rule that will make it harder for many workers to be qualify for the overtime exemption.

This rule goes into effect Dec. 1, 2016.

The key provisions include:

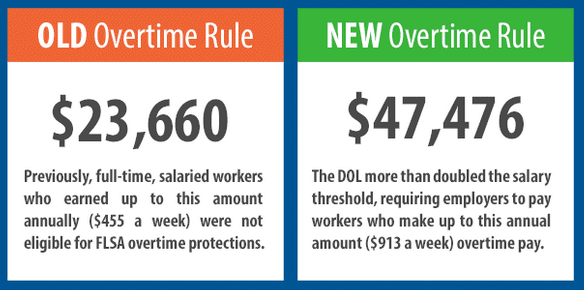

- Raises the salary threshold for overtime exempt status from $455 a week to $913 a week ($47,476 per year)

- Increases the threshold to qualify for the “highly compensated employee” exemption from $100,000 to $134,004 per year

- The salary threshold will be adjusted every 3 years, beginning January 1, 2020, based on census data

- For the first time, employers can use non-discretionary bonuses and incentive payments (including commissions) to satisfy up to 10% of the standard salary test. To qualify for this credit, the non-discretionary payments must be paid on a quarterly or more frequent basis and employers can make a “catch-up” payment if an employee doesn’t earn enough non-discretionary payments in a given quarter to meet the standard salary level test.

Notably, the final rule does not change any of the existing job requirements to qualify for an exemption.

What to do…

Identify current exempt employees who will lose exempt status based on the increased salary threshold (anyone earning under $47,476) and either reclassify these employees as non-exempt or raise their salary/non-discretionary compensation to meet the new salary test.

With changes coming to the Wage and Hour landscape, now is the time for employers to analyze the classification of each exempt employee and independent contractors. This will go a long way in avoiding huge headaches and penalties. Employers need to start preparing now by reviewing employee classifications and job descriptions, and consider how their pay systems could be affected if many of their exempt employees become hourly or if independent contractors are deemed employees.

We are available to assist you navigate this new rule and ensure your organization is in compliance.